After a two-year hiatus from blogging, I’m back! A lot has happened during this time: we welcomed a new family member in 2023 (the last one, I promise!), we were fortunate enough to secure a BTO in Tampines North with a completion date between late 2025 and mid-2026, and my salary has seen some small bumps since 2021. Additionally, my team has expanded, bringing new responsibilities and challenges.

Despite the turbulence in the world, including events like the Russian invasion of Ukraine in February 2022, conflicts in the Red Sea in October 2023, and the recent tragic attack by ISIS terrorists at Crocus City Hall in Moscow resulting in 113 casualties, I remain hopeful that we will eventually see better days. On the flip side, my company has faced difficulties in 2023, with impending retrenchment looming. Nevertheless, I hold onto hope for a brighter future.

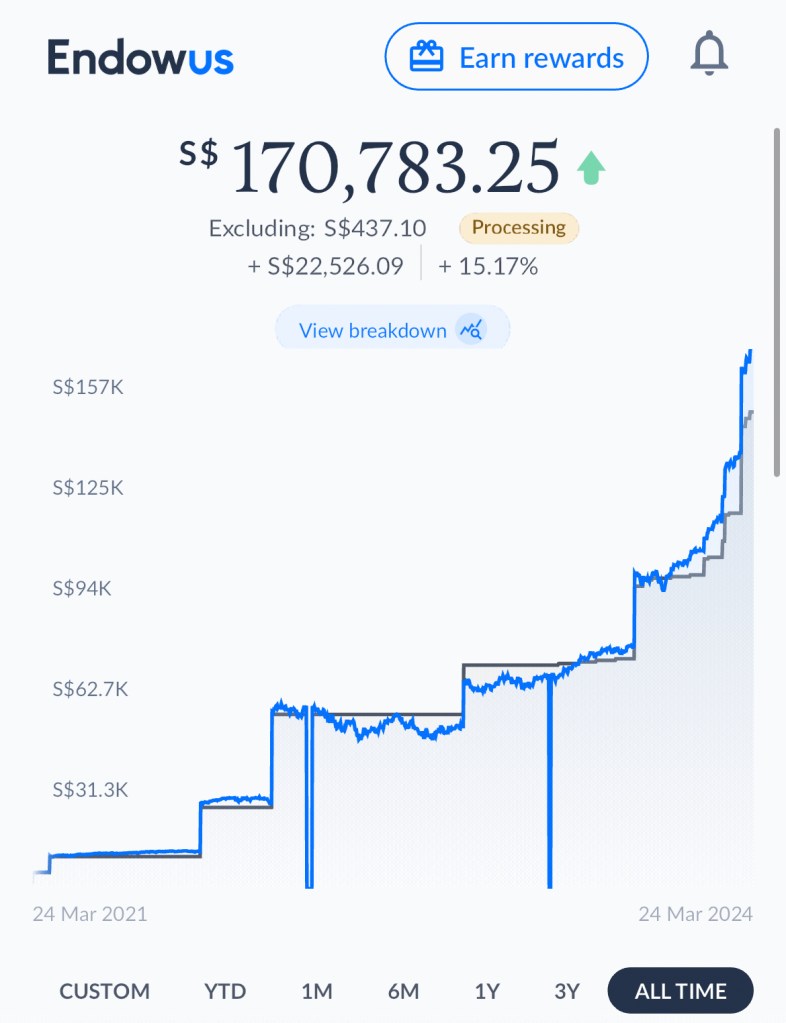

Amidst the chaos, there’s been positive news in the financial realm. The stock market has been booming since the onset of Covid-19 in 2020, and the crypto market has also seen a resurgence since early 2024 after a two-year lull. These developments indicate that my investment portfolio is on track, even surpassing expectations on my journey to financial independence.

The S&P500 has doubled since 2020, showcasing remarkable growth. Pictures indeed speak volumes, so here are my humble achievements to date:

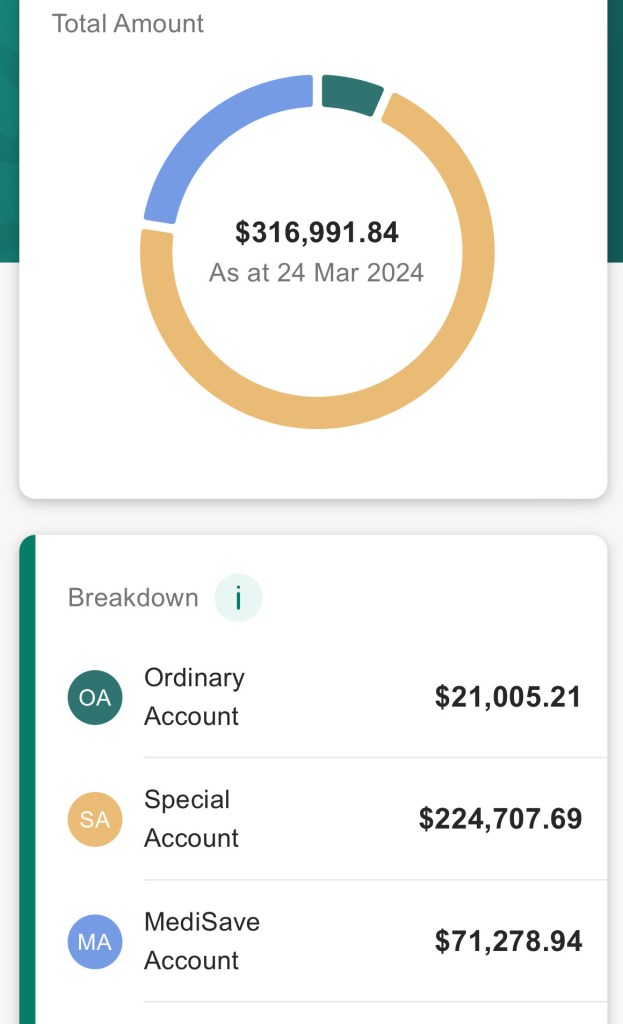

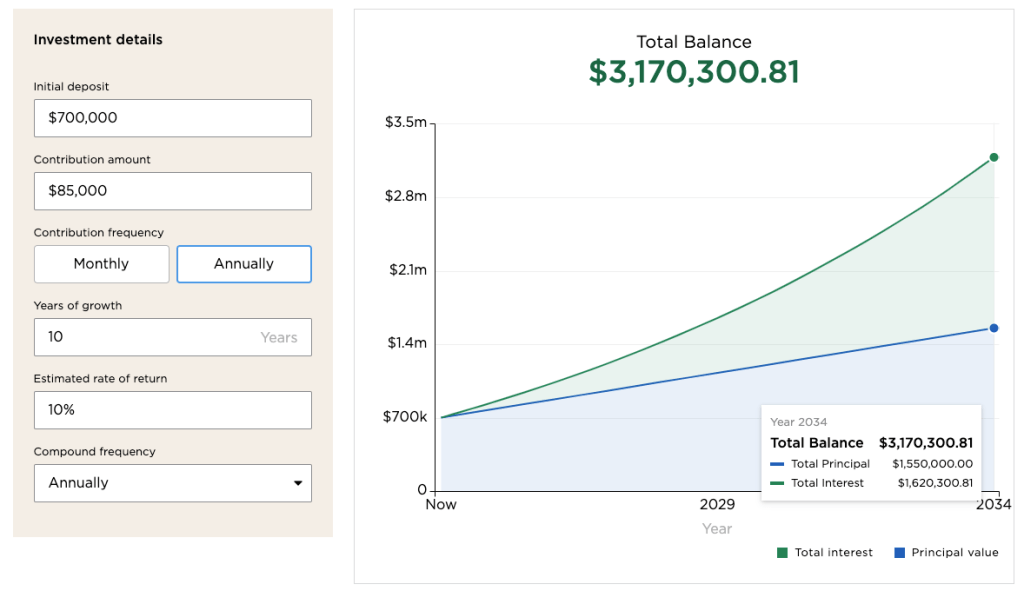

My stock investments, including a 50k USD meta stock at Webull, now total 700k SGD. This milestone makes early financial independence feasible for me, based on the following practical assumptions:

- Monthly recurring investment of 5k SGD (3k SGD cash, 2k SGD OA)

- Annual one-off bonus injection of 25k SGD

- Average annual investment return of 10% for the next 10 years

Projected growth trajectory of my stock portfolio over the next decade suggests that my family of five could achieve financial independence by my age of 48, a possibility I hadn’t imagined before. And this estimation is conservative, as it doesn’t include my CPF and crypto portfolios.

With our goal within reach in less than 10 years, it’s time to reward ourselves, as advised by YouTuber Rami. It’s time to learn the art of spending and embrace a richer life during retirement. Surprisingly, we haven’t quite mastered this skill yet, as we’ve lived quite frugally until now.

As a first step, I’ve decided to increase our travel budget to a minimum of 10k SGD per year. Let’s splurge and enjoy the fruits of our labor!