Happy new year! after disappeared for 7 months, opps!

A lot has happened in this unprecedented year, many wouldn’t expect that the coronavirus, a vibe word used frequently nowadays, is still spreading tirelessly across the boundaries. Countries, particularly the Western, are struggling to curb the virus successfully. Thankfully, Singapore has more or less kept the virus under control since Q4 2020, albeit we are still far from getting back to pre-covid lifestyle. With government starts vaccine distribution in Dec 2020, we are hopeful to achieve herd immunity by end of this year, and life should, optimistically, get back to normal.

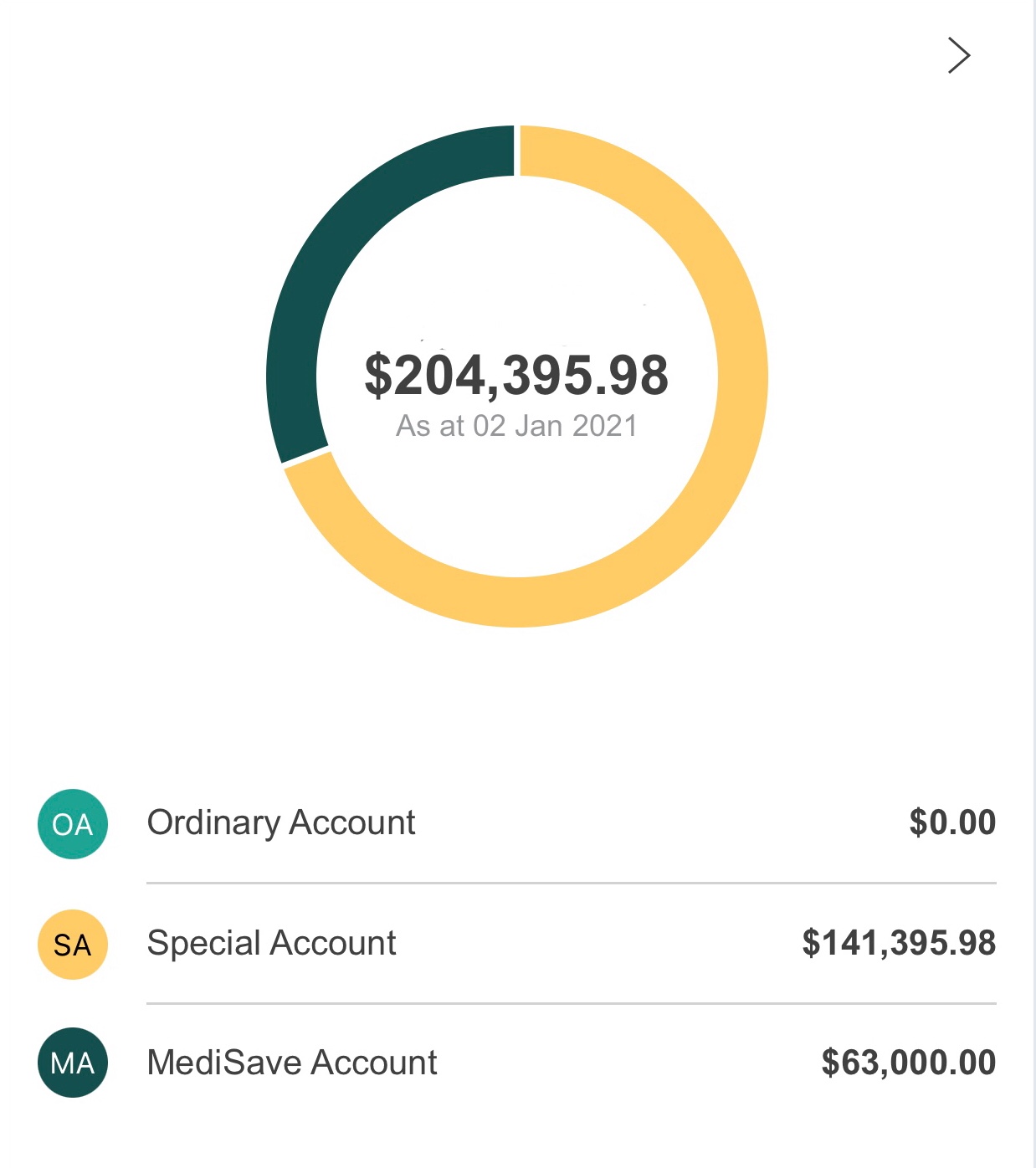

Despite the challenges faced both in personal and professional life, I am thrilled to see that my CPF balance finally hits SGD 200k milestone, 1 year ahead of my 35th years old birthday. To be frank, I do not set a detailed milestone target for my CPF balance, other than a vague goal of 1M65 (1 million CPF balance at 65 years old, another vibe word within the CPF community).

To add icing on the cake, I have make a voluntary contribution of SGD 3k into my Medisave account (MA), rounding it up to balance SGD 63k, further optimising my upcoming tax relief in year 2021. Luckily or unluckily, I am probably going to be in the tax bracket of 15% this year, any tax relief opportunity is a great deal of saving for me from now on. A mere SGD 3k MA top up could mean a reduction of tax up to SGD 450, enough to buy 6 cans of 1.8kg Milk powder for my 3 years old toddler!

In addition, I have, as usual, transferred Ordinary account (OA) to Special account (SA) to take advantage of the increased compound interest of 4%. The ultimate goal is to ensure achievement of FRS (full retirement sum) by 55 years old. Afterwhich CPF, particularly OA and SA, will turns into high interest saving account for my retirement, where I can withdraw the money at my wish via PayNow (or keep the sum intact to earn high interest).

In my humble opinion, CPF is a powerful tool, if used right, to supplement one’s retirement needs – it suits perfectly the famous saying of “low risk high return”, heck it should even be seen as “no risk high return”! My logic is simple, if we have already contributed, willingly or unwillingly, 37% of our monthly salary (20% from employer, 17% from employee), it is absolutely necessary to invest at least some extra efforts to maximize the returns, making sure that we can reap the fruits of your labor at the end of our working life, and hopefully before our health starts deteriorating.

I wish everyone a cheerful new year, stay safe!