Year 2020 is no doubt an eventful year, US-China trade war, Hong Kong protest, COVID-19 outbreak, and the most recent US Fed emergency interest cut.

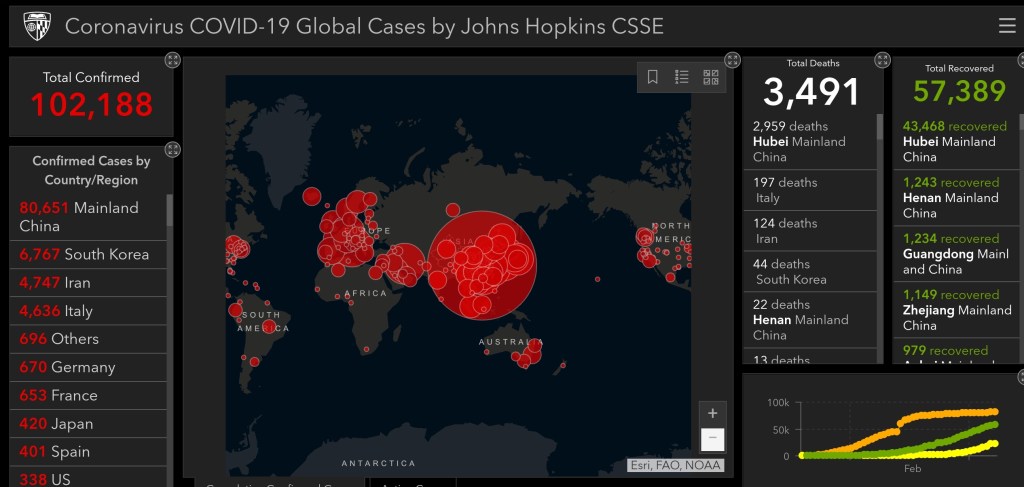

It is clear that the global economy is now seriously hit by the outbreak of COVID-19, which originated from Hubei province, China, and has infected more than 100k population in less than 3 months time. Many countries have now strengthened border control, restricted travellers from affected countries from entering into the countries.

Singapore, a tiny urbanized country, which depends heavily on import and export business, has recently downgraded its GDP growth forecast in year 2020 from 1.5% to 0.5% (average). The fear of upcoming recession is getting real, miniters are forgoing one month of salary, 85,000 civil servants expect year-end bonus that is the lowest in 10 years.

Market sentiment in capital market is swinging from the extreme greed since Q4 2019 to extreme fear in early 2020, particularly the “roller coaster” share price swing last week. Is this the beginning of market crash, with the last one being in 2009, 11 years ago? Well, your guess is as good as mine.

Should we sell everything and keep our hard-earned cash in biscuit tin under the bed? Absolutely NO, in fact, in times like this, cooler heads prevail. As a long-term investor, this is exactly the moment we should, cautiously, deploy our reserved warchest into the market. If the crash is inevitable, it will be my first golden opportunity to get involved in a major financial crisis, and fortunately, I am ready to fight the battle.

Lastly, please do not blindly bet your entire networth into the market in lump sum right now, things might get worse in the coming months and there is no certainty that the rebound will be as quick. Have a plan, and execute your plan with dicipline, it will pay off nicely.