It is probably not uncommon to hear this – time in the market is better than timing the market. These are 2 different investing philosophies, ie. waiting for market to crash before pulling the trigger, or dollar-cost-averaging every fixed period of time, ignoring the market condition.

I was once a believer of stock picking, creating many templates to analysis the P/E ratio, P/B ratio, discounted cash flow, John Neff screener, Graham checklist, etc etc. It is intriguing to add more and more screeners into the template, only to find that they are most of the time conflicting with each other. This often complicates the stock picking process particularly to a clueless amateur like myself. As a result, those templates get dumped into cold storage, and I start following the leads from other financial bloggers.

My favorite is definitely AK71. If you are into financial bloggers in Singapore, you must have heard of his name in various online forums. He is very famous for his extremely frugal lifestyle, but at the same time his brilliant, selfless, down to the ground sharing of his investing ideas back in 2009/2010 when he first started blogging as a hobby. His mid six digits dividends income is a legendary achievement in Singapore. Unlike many other financial bloggers who are fond of US / global market, AK71 achieved his financial independence in his early 40s only by investing in SG stock market, particularly in REITs.

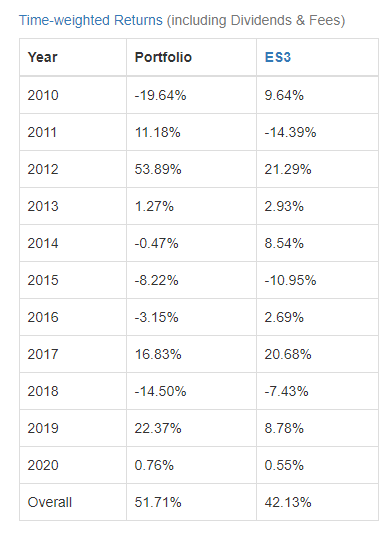

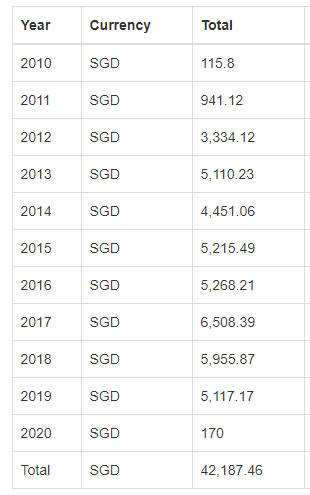

Followings the free-of-charge stock tips from AK71, and some guts feeling, I built a 8-10 portfolio (mainly REITs) since year 2010/2011, it performed very well and even beat the STI benchmark (ES3) in some good years (particularly in year 2012). The portfolio produced some 4 digits passive dividend income yearly.

The buy and forget approach yielded quite good profits in dividends for the past 9 years, however, there are also few stocks which I have to cut loss eventually as fundamentally the business is losing its steam, namely Sabana REIT and First REIT. I am grateful that the losses, though painful, are still within tolerance and insignificant as compared to the losses incurred in Forex Trading and Cryptocurrency Mining (story for another day). All in all, my result in stocks investing till date is still in green. I do aware that my “achievement” in stocks investing is no less than pure luck. Though I did try to spend some time studying fundamental & technical analysis, the interest often gets faded quite easily mainly due to the pressure in my day job.

In year 2018, I chanced upon a thread in HWZ Money Mind forum named “Shiny Things Club”, the thread starter was a successful proprietary trader and wrote a book “Rich By Retirement” illustrating ETF investment terminology in Singaporean context. The simple and effective DCA (dollar cost averaging) investing method quickly gets to me. I then started my ETF investing journey since late year 2018 via low cost broker IB (interactive broker) recommended by Shiny Things. I simply invest a fixed sum every month into IWDA, and “go to pub”.

Since DCA requires little effort in stock analysis, I now have more time to focus in building my active career, which produces more invest-able capital to be injected into my portfolio. My next action plan is to divest my SG stocks completely and transfer the capital into global ETF, so as to balance the geographical risk. To be honest, the DCA method, though effective and is a proven method to grow your asset steadily, is rather routine and boring. To keep the momentum lasting for >20-30 years, I have decided to allocate a small amount of my savings (5-10%) in speculative investment – cryptocurrency mining and trading. Please note that this is not for everyone, if you have other casual hobbies to divert your attention, please do so and stay away from bitcoin, ethereum and whatever shitcoins recommended by some “financial gurus”.

In a nutshell, time in market is always more superior than timing the market, unless you are the legendary Warren Buffet, Graham Phillips, Jim Roger, or the infamous AK71 . This is the reason why most of hedge funds are not able to beat the benchmark CONSISTENTLY. Therefore for majority of normal peasants like us, it is recommended to stick to simple (and boring) investment method, and spend your time and energy in other activities, let the compounding interest does its magic to fund your retirement.

What is your opinion? Do you prefer to analyze and cherry pick stocks on your own? There is no right or wrong answer, just personal preference.