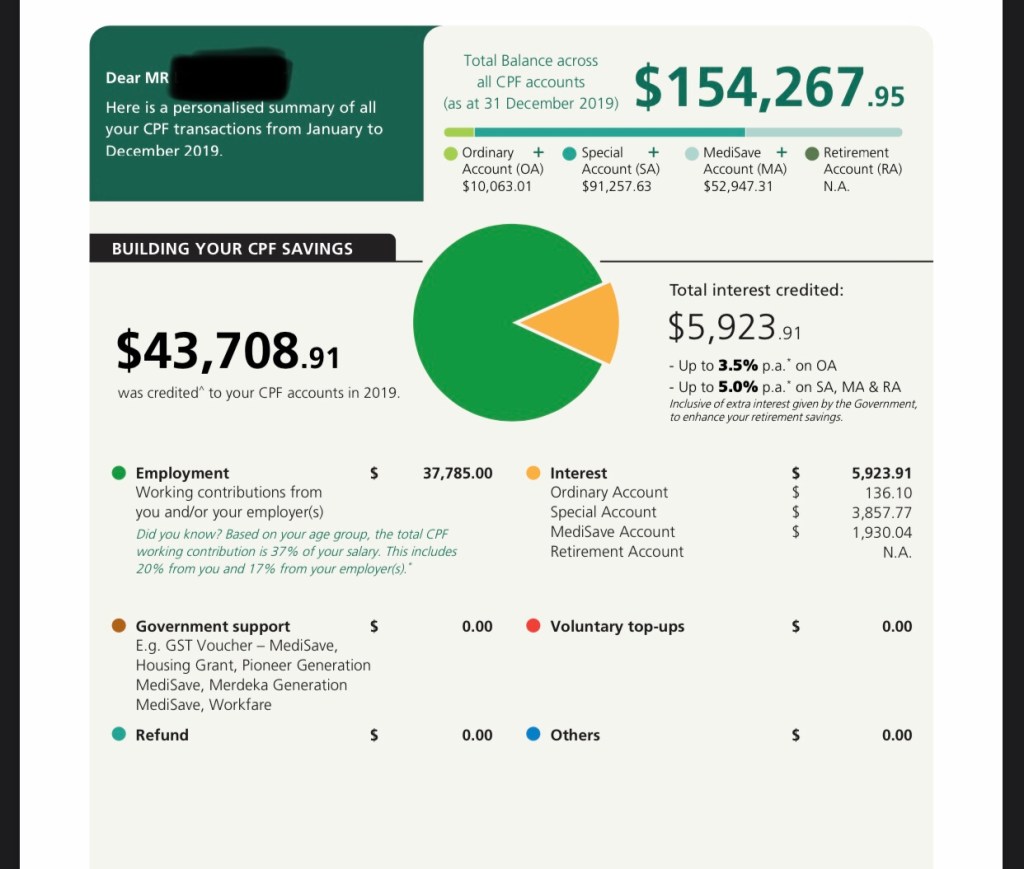

Stepping into year 2020, it is time to review how is the performance of my biggest bonds portfolio – CPF. While CPF can be seen as a controversial political topic in Singapore, my take is that since it is a mandatory contribution (and a huge 20% deduction from your monthly salary) for all Singaporean and PRs, it is in my best interest to find the best way to “hack” the system.

One common method encouraged by most financial bloggers is to do OA to SA transfer. This way you get almost double the compounding interest! One may argue that such transfer is one way ticket since you are not allowed to do SA to OA or MA transfer, I have the same thought and therefore the procrastination for few years before I made the call and pulled the trigger in year 2018. I simply cannot resist the 4% compounding interest in SA! This will helps a lot in shortening my journey to FI (financial independence) by achieving FRS hopefully before 40 years old. I am keepiNg track the progress using an excel file shared by HWZ few years ago, will be detailing the plan next time.

I have been accumulating some $$ in OA few months ago for preparation of refinancing my housing loan (currently I am with OCBC housing loan, its interest rate was exaggerated from 1.3% to 2.4% in a year time!), else OA should usually be emptied and transferred to SA every month end. In addition, I just did a SGD 7k SA top up before end of January, hopefully i could meet FRS (Full Retirement Sum) by late 30s.

How do you plan your CPF contribution, regardless if you trust the system or not? Do share your thoughts in comment section for discussion.